ev charger tax credit form

Credits that reduce regular tax before the alternative fuel vehicle refueling property credit. Just buy and install by December 31 2021 then claim the credit on your federal tax return.

Rebates And Tax Credits For Electric Vehicle Charging Stations

This federal EV infrastructure tax credit will offset up to 30 of the total costs of purchase and installation of EV equipment up to a maximum of 30000 for commercial property and 1000 for a primary residence.

. Qualifications for the Vehicle Conversion to Alternative Fuels or Electric Vehicle Charger Tax Credits. We try to maintain this page regularly but another resource that may. Up to 1000 Back for Home Charging.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. Regular tax before credits.

It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs. Enter 100 unless the vehicle was manufactured by Tesla or General Motors Chevrolet Bolt EV etc To claim your federal EV tax credit you must fill out Form 8936 along with Form 1040. If you are a New York State resident looking for a new car its a great time to buy or lease a plug-in.

The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchased EV charging infrastructure. Basically if you have enough credits for the year even if you still have tax liability and no AMT your TMT will dictate if you will get the EV Charger credit.

Electric vehicle chargers - 10 of the cost of the charger and its installation or 2500 whichever is less. Enter the sum of the amounts from Form 1040 1040-SR or 1040-NR line 16 and Schedule 2 Form 1040 line 2. The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit.

Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. Combine that with a Federal Tax Credit of up to 7500 and its an opportunity you wouldnt want to miss. The EV tax credit is 7500 the EVSE credit on our station is 1000 and our solar credit is 8800.

By filling out Form 8936 at the same time that you file your federal tax returns you can qualify for up to 7500 in tax credit earnings. Credits on Form 1040 1040-SR or 1040-NR line 19 and Schedule 3 Form 1040 lines 2 through 5 and 7 reduced by any general business credit reported on line 6a any credit for prior year minimum tax reported on line 6b or any credit to holders of tax credit bonds reported on line 6k. About Publication 463 Travel Entertainment Gift and Car.

Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchase d EV charging infrastructure. Previously this federal tax credit expired on December 31 2017 but is now extended through December 31 2021. The charging station must be purchased.

For residential installations the IRS caps the tax credit at 1000. Enter the total of any write-in. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station. For residential property 1000 is closer to an absolute cap because a taxpayer can have only one primary residence. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles.

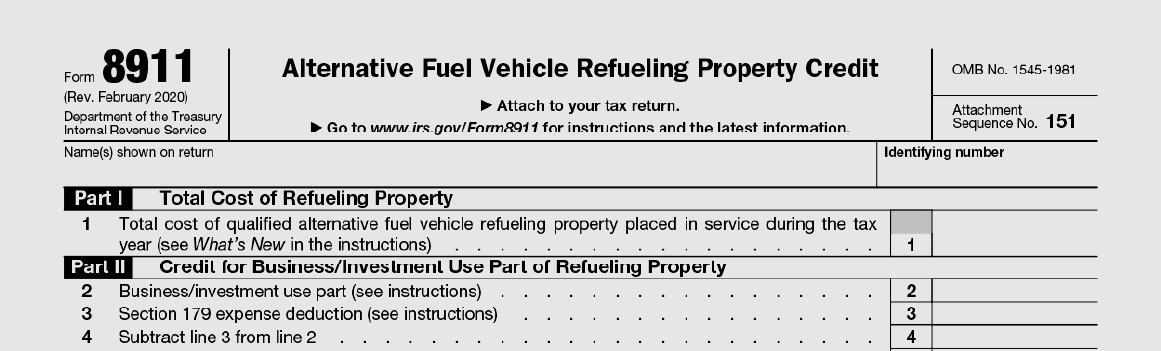

Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. Went round n round with them before somebody actually could give me a correct answer. Tax Credit Form Available 210 TurboTax devildog125.

FEDERAL TAX CREDIT FOR EVSE PURCHASE AND INSTALLATION EXTENDED. Learn more about how to claim your electric vehicle credits and potentially save thousands of dollars on Tax Day. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

Its subject to TMT whereas other credits like The EV car credit and Solar credits arent. Use this form to figure your credit for alternative fuel vehicle refueling property you. In this article we will go over ways to save on installing an electric vehicle charger what EV rebate program you might be eligible for and how these.

Enter the regular tax before credits from your return. Form 6251 is for AMT and is has the calculated TMT or Tentative Minimum Tax. The Charge NY initiative offers electric car buyers the Drive Clean Rebate of up to 2000 for new car purchases or leases.

For New Yorkers the states Drive Clean Rebate adds an additional rebate of up to 2000 and New York businesses can apply that credit to every EV they purchase. It cannot be used to increase your overall tax refund it is still a. Putting electric vehicle EV charging stations at your commercial property or home is a good investment opportunity especially given the tax credits and incentives available to you.

Moreover companies that purchase low- and zero-emission trucks and buses may be. Since installation costs are significant for EV chargers this rule. Grab IRS form 8911 or use our handy guide to get your credit.

Replies 17 Views 2420. But Uncle Sam is not the only. Form 8936 is used to figure credits for qualified plug-in electric drive motor vehicles placed in service during the tax year.

And its retroactive so you can still apply for installs made as early as 2017. Figured it out. Of course all of this adds up to 12k so Im trying to figure out how to get the EV and EVSE credits to apply first followed by the solar credit since I understand the solar credit can carry over to next year whereas the other credits cant.

Federal tax credits offset up to 7500 of the cost of purchasing a new electric vehicle. In other words costs of 100000 per location are eligible for the credit potentially yielding a combined credit far in excess of 30000 for taxpayers who installed commercial chargers at multiple locations. Unlike some other tax credits this program covers both EV charger hardware AND installation costs.

EV Charger Tax Credit - Form 8911 - Tentative Minimum Tax Mirak. Qualified 2- or 3-Wheeled Plug-In Electric Vehicle Credit Under Section 30Dg Notice 2016-15 Updating of Address for Qualified Vehicle Submissions. Their consumer software does not support the EV charger tax credit.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations. If you purchased your EV more than 3 years ago and the vehicle is still eligible for the tax credit you can file an amended return to. And while it is a non-refundable credit ie.

Jan 26 2022 12452 PM. The Vehicle Conversion to Alternative Fuel and the Electric Vehicle Charger tax credits are still available. Form 1041 Schedule G.

If you claimed an alternative fuels tax credit in any tax year that began before January 1 2011 use Form CT-40 Alternative Fuels and Electric Vehicle Recharging Property Credit or Form IT-253 Claim for Alternative Fuels Credit to claim a credit carryover or to calculate any recapture of the alternative fuels credit that was allowed.

Sun Country Highway Clippercreek Ev40p 32 Amp Plug In Ev Charging Station Costco

How To Choose The Right Ev Charger For You Forbes Wheels

Charge Your Ev Up To 7x Faster With A Level 2 Home Ev Charger

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Blink Ecotality By Frog Design Machine Design Id Design Ev Chargers

How To Claim An Electric Vehicle Tax Credit Enel X

Featured Design Strategy Work Design Strategy Supermarket Design Parking Design

Residential Charging Station Tax Credit Evocharge

Ev Charging Stations 101 Wright Hennepin

Fuseproject Product Ge Wattstation Electric Car Charger Ev Charger Charger Car

Tax Credit For Electric Vehicle Chargers Enel X

Home Charging For E Mobility Designed By Kiska On Behance Station De Charge Electronics Projects Voiture Electrique

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

How To Choose The Right Ev Charger For You Forbes Wheels